Staking is the process of delegating (or locking up) cryptocurrency in a wallet. When crypto is staked, it earns interest, called staking rewards.

Staking interest rates vary but often exceed traditional savings account rates, making it very enticing for users, especially those interested in holding crypto for a long time and don’t have immediate needs for their funds.

How much staking interest can you earn with Ethereum Staking?

Staking rates vary by platform and coin, but you can expect to see 2-6% APY (annual percentage yield) for staking Ethereum. Below are the best staking interest rates for staking services that support ETH Staking.

ETH Staking Interest Rates

Staking helps secure and run proof of stake (P.O.S.) blockchains and rewards those contributing with yield for doing so.

People are interested in staking because it incentives saving or holding your crypto assets. It allows you to grow your position without using riskier alternatives, such as trading or lending.

But not all cryptocurrency supports staking. For example, Bitcoin does not support staking natively, as it was not built into the protocol. Bitcoin is a proof of work (P.O.W.) blockchain. Hence, the only way to earn interest with Bitcoin is to lend it.

Ethereum supports staking natively in its protocol, with an upgrade completed in 2022.

However, staking Ethereum is not a straightforward process. If you want to stake ETH by yourself, you must set up a validator (in effect, a server) and have 32 Ether to “lock up” to begin. Not only is this costly, but it is also too complex for most people.

Staking-as-a-service

ETH Staking services (staking-as-a-service) platforms and exchanges are a solution to provide easy staking for most people.

In brief, exchanges and staking services make staking on their platform much easier, as they handle all the back end work (things like running validators and “pooling” up ETH in bunches of 32) and, in turn, take a commission of your yield for the privilege.

Comparatively, this makes staking on exchanges far less complex, as simple as clicking ‘stake’ on deposited crypto assets. Keep scrolling for more info on the three staking-as-a-service platforms we recommend.

Why do different platforms offer different staking rates?

Since exchanges and staking services run their own validators, it takes time and money to offer these resources and is one reason why the interest rate each offer can vary.

The staking yield rate at the protocol level is affected by many factors, such as the amount of staked coins at any time. The more coins staked, the lower the overall interest rate. This is also why staking yields fluctuate often and are hard to calculate on a consistent yearly (APY) basis.

Popular staking services

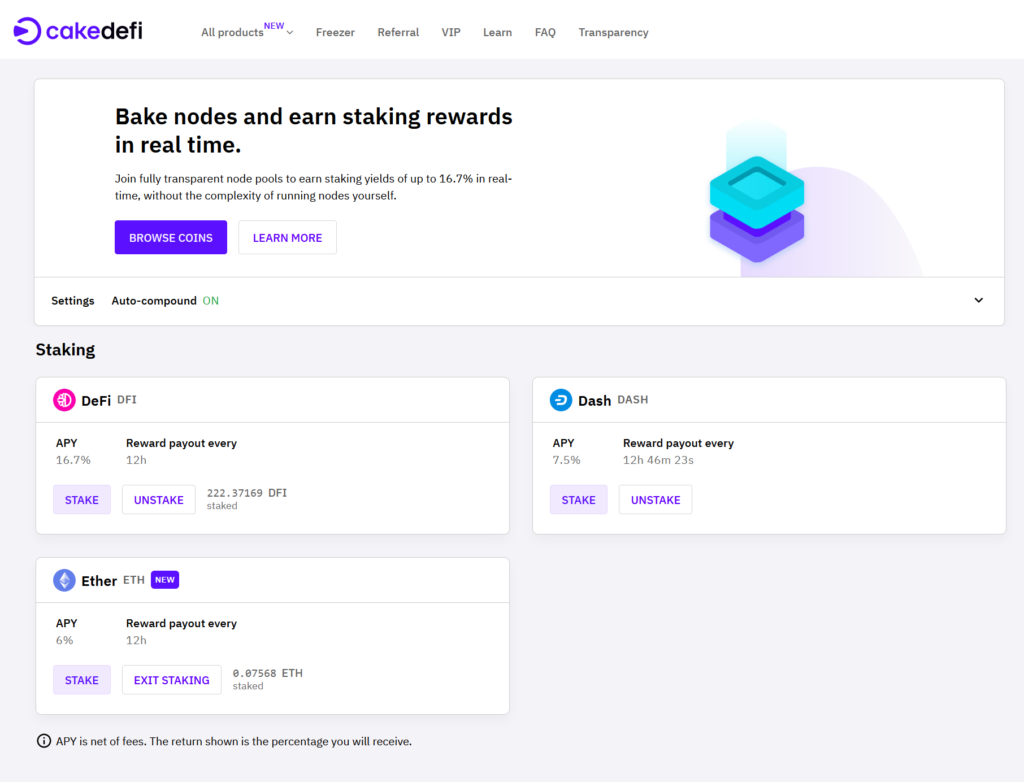

Bake (formerly Cake Defi) Staking

- Great rates

- Easy-to-use app

Bake is a centralized finance platform that allows users to earn interest on their cryptocurrency holdings, borrow and lend digital assets, and participate in yield farming.

One of the main features of Bake is its lending and borrowing platform. Bake also offers a range of yield farming opportunities, where users can earn rewards for providing liquidity to certain DeFi protocols or participating in other activities without requiring as much technical skills as is required by using DeFi directly.

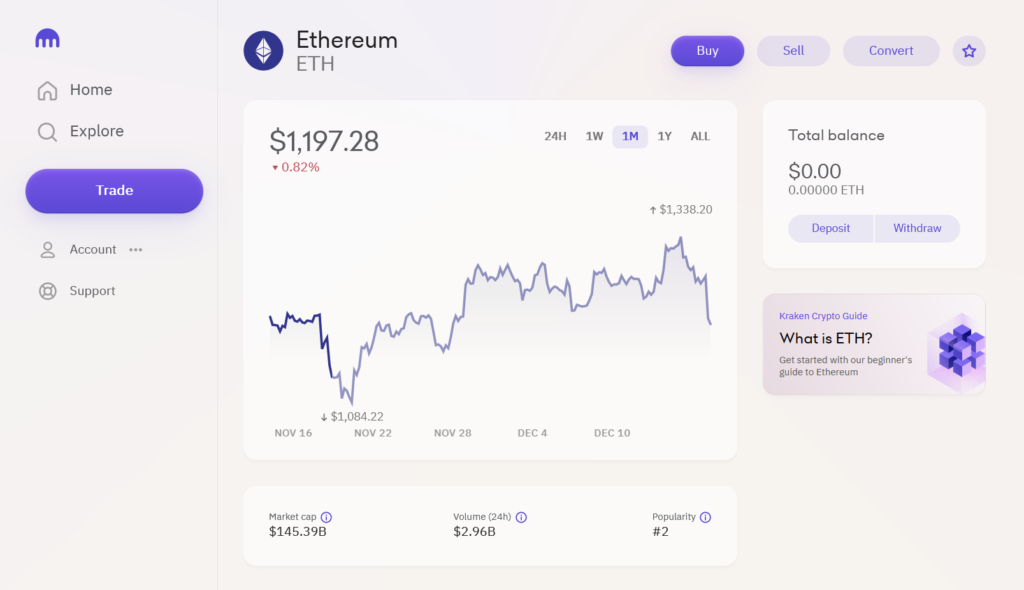

Kraken Staking

- Good rates

- Trusted exchange

Kraken is a digital asset exchange platform founded in 2011 and headquartered in San Francisco, California. The platform allows users to buy and sell a range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, and trade various digital asset pairs.

Kraken offers staking as part of its platform.

Kraken is known for its low fees, advanced trading tools, and strong security measures. The platform offers a user-friendly interface for beginners and advanced features for more experienced traders, including margin trading, futures trading, and options trading.

Overall, Kraken is a respected and well-established digital asset exchange platform trusted by millions of users worldwide.

Learn more about Kraken Staking

TLDR;

Staking is the process of delegating cryptocurrency in a wallet. When funds are staked, they are eligible to earn interest or yield. The interest rates for staking vary but can meet or exceed what you see in traditional savings accounts, making it very enticing for users interested in holding crypto for a long time and not having immediate needs for their funds.

Staking rates vary by platform and coin, but you can expect to see 4-8% APY (annual percentage yield) for staking Ether.

Staking allows you to grow your position without riskier alternatives, such as trading or lending. Investors are interested in staking because it incentives saving and holding crypto assets by rewarding those who contribute with yield while helping secure and run proof of stake (P.O.S.) blockchains.

No, Bitcoin does not support native stake, as it was not built into the protocol. Bitcoin is a proof of work (P.O.W.) blockchain. The only way to earn interest with Bitcoin is to lend it.

ETH staking rates depend on the service you use. Our site tracks and ranks these ETH staking rates for you.

Yes. As of 2022, Ethereum now supports staking natively in the protocol.

If you want to stake ETH by yourself, you must set up a validator (a powerful server) and have 32 Ether to” lock up.” Suppose you do not have 32 ETH or access to a validator. In that case, you can utilize staking services (staking as a service) platforms and exchanges.”If you want to stake ETH by yourself, you must set up a validator (a powerful server) and have 32 Ether to “lock up.” If you do not have 32 ETH or access to a validator, you can utilize staking services (staking as a service) platforms and exchanges.

As of 2024, The Coin Interest Rate team recommends Kraken Staking.

Bake offers staking as a service for Etherereum.

Kraken offers staking for the following coins: ETH, MATC, SOL, ADA, DOT, and others. Learn more about Kraken Staking