Compare Crypto Loans

Compare the best platforms offering crypto-backed loans. Find the lowest rates and most favorable terms.

What Are Crypto Loans?

Crypto loans allow investors to secure cash or stablecoins by using their Crypto holdings as collateral. This strategy provides access to liquidity without requiring you to sell your assets, thereby preserving your potential for future gains.

Why Get a Crypto Loan?

A Crypto-backed loan enables you to unlock the value of your holdings while maintaining your long-term investment position. This benefits investors who need cash for expenses or other investments but do not want to liquidate their Crypto.

- Tax Efficiency: Avoid triggering a taxable event by borrowing instead of selling.

- Access to Liquidity: Use your crypto's value without selling it, allowing you to maintain exposure to market growth.

- Flexible Use of Funds: The funds from a crypto loan can be used for any personal or business need, including further investment.

Benefits of Crypto-Backed Loans

- No Credit Checks: Loans are secured by the value of your crypto assets, bypassing the need for traditional credit scores.

- Fast Processing: Borrowers can often receive funds within 24-48 hours, which is much faster than traditional bank loans.

- Maintain Market Exposure: You continue to benefit from any potential price appreciation of your collateralized Crypto.

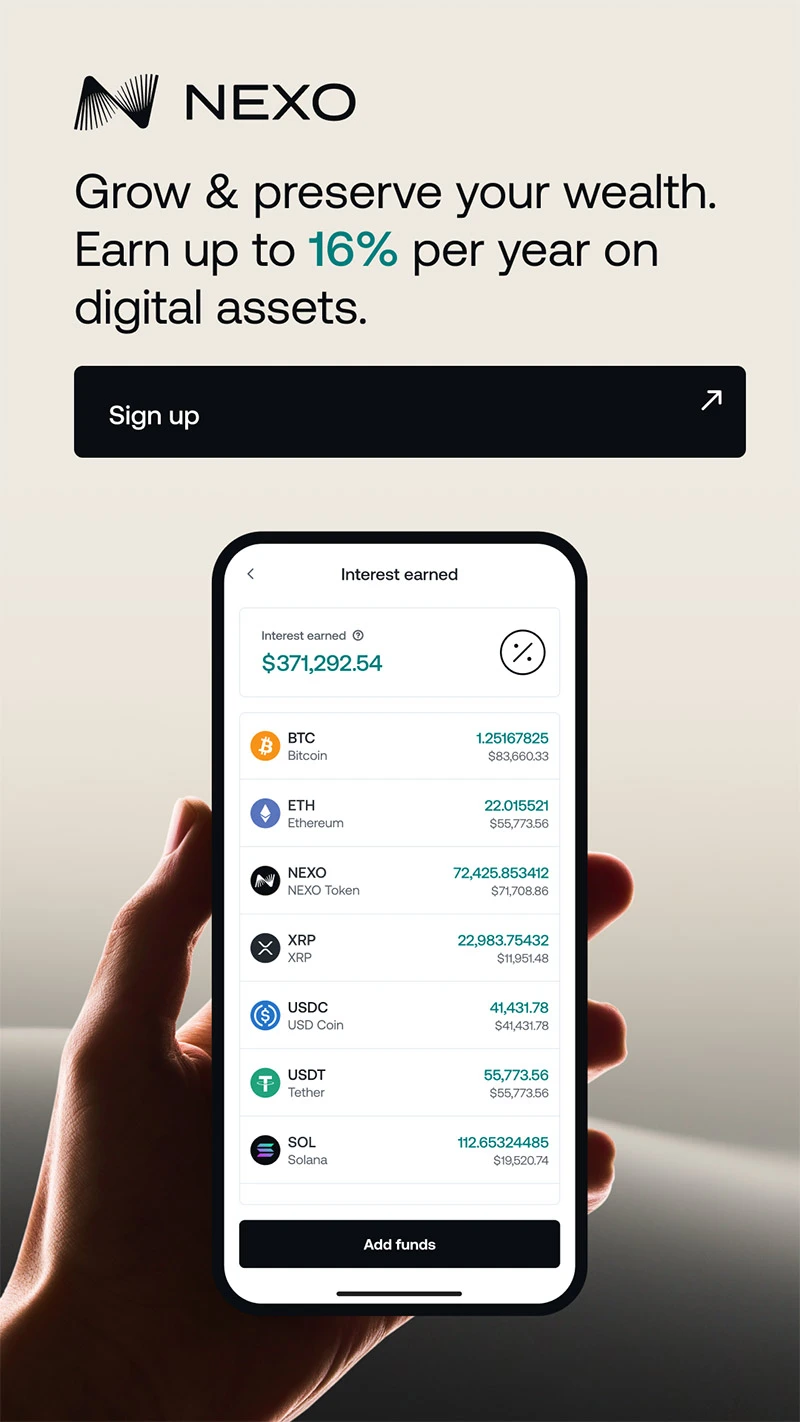

Compare Crypto Loan Platforms

Above are top-rated Crypto loan providers offering competitive rates and flexible repayment terms. Each listing shows key metrics like loan rate, LTV limit, collateral requirements, and origination fees.

Risks to Consider

While borrowing against crypto offers significant benefits, it's essential to understand the potential risks:

- Market Volatility: A sharp drop in the value of Crypto could lead to the liquidation of your collateral.

- Interest Rates: Rates can vary significantly between different platforms and assets.

- Platform Security: Always choose reputable and secure lending platforms to minimize risks related to fraud or platform insolvency.

Crypto Loan FAQs

Is taking a Crypto loan taxable?

Borrowing against your Crypto is generally not a taxable event, as you’re not selling your crypto. However, consult a tax advisor for your situation.

What LTV ratio is safe?

Many investors prefer staying below 50% LTV to reduce the risk of liquidation during market dips.

How fast can I get a crypto loan?

Most platforms process loans within 24–48 hours after collateral is deposited and verified.